All Categories

Featured

Table of Contents

These alternative investment platforms allow you to discover actual estate, start-ups, and tech options. By utilizing these systems, brand-new financiers can find out around lots of kinds of investment options while gaining real-life experience. Keep in mind to greatly veterinarian the business prior to investing as crowdfunding is not heavily regulated and is riskier than standard financial investment resources.

All financial investments are threats yet with the best assistance, you can have extra self-confidence in your decisions. Diversification and Threat Management- by expanding your profile you likewise diversify your risk. Not all financial investments have the very same timelines, rewards, or risks. This is the most effective means to build a financial investment foundation and create long-lasting wide range.

Due diligence is the most effective way to comprehend the financial investment, the sponsor, and the danger variables. If a sponsor isn't happy to review threat, incentive, and timelines, that is a red flag. Successful Non-Accredited Capitalist Involvement- Some companies use the capacity to spend along with them such as This company allows retail investors to get passive income by using their system to spend through an equity REIT.

Are there budget-friendly Accredited Investor Real Estate Investment Groups options?

Crowdfunding is open to all capitalists yet non-accredited are controlled on financial investment amounts based on earnings. Exception 506 B- allows up to 35 innovative unaccredited investors to participate along with recognized capitalists.

To stay compliant they must follow guidelines regulating personal positionings discovered in. Compliance Requirements for Syndicators- Forbids syndicate recommendation settlements for anybody other than SEC-registered brokers Non-accredited financiers get extra disclosures Sponsors should give offering files Financier Security Steps- The laws safeguard investors from fraud and guarantee that publicly traded firms give exact economic details.

Investing with genuine estate crowdfunding systems can be an eye-catching alternative to buying property the typical means. It lets you merge your cash with other investors to enter on offers you couldn't access otherwisesometimes for as low as $10 (Residential Real Estate for Accredited Investors). It likewise makes diversifying your real estate profile throughout numerous properties simple

Financiers profit from building admiration, understood at the end of the holding period, and regular rental revenue, dispersed quarterly. Similar to a lot of property, Showed up considers its buildings long-term financial investments. So holding periods are generally 5-7 years for long-lasting services and 5-15 for holiday rentals. The system doesn't permit users to leave their investments before the holding period mores than.

Recognized and non-accredited financiers can then get shares of properties for just $100. The business goes for 12- to 24-month long-term leases and makes use of major booking websites like Airbnb and VRBO for temporary services. To make cash, Showed up consists of an one-time sourcing charge in the share price (3.5% of the residential property purchase price for lasting rentals and 5% for vacation services).

Real Estate Syndication For Accredited Investors

Additionally, some residential or commercial properties are leveraged with a home mortgage (normally 60-70%), while others are purchased with cash. All mortgages are non-recourse, implying capitalists aren't accountable for the debt and do not need to qualify for credit rating. Additionally, each building is housed in a Series LLC to safeguard financiers versus individual responsibility and the off possibility that Arrived ever before fails.

You can also access your account through an Apple app (presently, there's no Android application, yet the firm intends to launch one in 2024). The company site has a chatbot for asking FAQs and sending messages, which it generally replies to within a day. The website also notes a support e-mail address but no telephone number.

How can Accredited Investor Property Investment Opportunities diversify my portfolio?

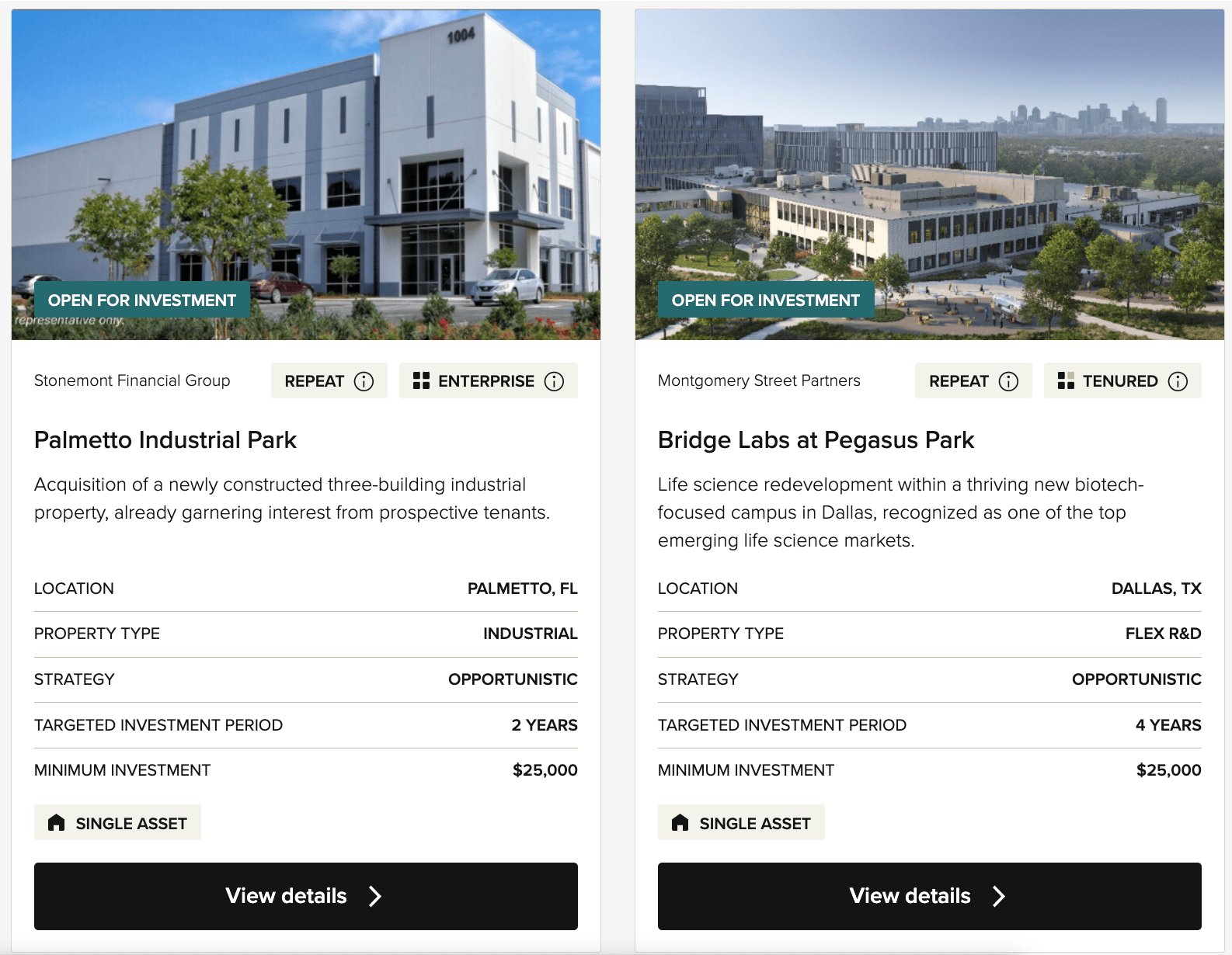

Besides a personal REIT, the business does not sponsor its very own bargains. Instead, it allows genuine estate enrollers use to have their bargains vetted and noted on the system. Once moneyed, investments are after that taken care of by the initial enroller. CrowdStreet offers all sorts of commercial realty financial investments: multifamily, retail, workplace, clinical building, self-storage, industrial, and land possibilities.

According to the firm, equity financiers commonly earn quarterly rewards as a share of profits, while debt capitalists make quarterly returns at an agreed-upon interest. Nonetheless, circulations aren't assured, and in some cases returns aren't recognized till the property markets. In addition, there is virtually no alternative to redeem your capital or exit your financial investment prior to the hold duration ends.

Crowdstreet costs real estate sponsors charges for utilizing the platform. Those charges minimize investor distributions (Accredited Investor Real Estate Platforms).

Compared to other systems, CrowdStreet has a high barrier to entry. It's just available to recognized investors, and the minimum investment for many deals (consisting of the private REIT) is $25,000. Individuals can make deals, track their investment efficiency, and connect directly with sponsors through an on-line website, however no mobile app.

Exclusive Real Estate Crowdfunding Platforms For Accredited Investors

The firm web site has a chatbot for asking FAQs or sending messages as well as a call e-mail address. According to the firm web site, as of 20 October 2023, CrowdStreet innovators have spent $4.2 billion across over 798 bargains, of which 168 have been realized.

It detailed its very first fractionalized residential or commercial property bargain online in 2012. Because then, the company has actually moved to a personal REIT design. Individuals can choose in between investment plans that prefer long-term appreciation, supplementary income, or a mix of both.

We recommend Fundrise if you want a truly easy investing experience. Select a financial investment strategy that fits your goals, established auto-investing, and you're ready. RealtyMogul is an on the internet industry for industrial property offers. However, it likewise uses 2 personal REITs: one that concentrates on creating month-to-month rewards for investors and one more that targets lasting resources appreciation.

Depending on the deal, financiers can generally anticipate holding periods of 3 to 7 years. Exiting your investment prior to the end of the hold duration or marketing it isn't possible. Some are readily available to non-accredited investors for a $500 minimal financial investment, while others are only open to accredited financiers and have minimal investments of up to $50,000.

Table of Contents

Latest Posts

Tax Lien Foreclosures

Delinquent Tax Payment

Surplus Funds

More

Latest Posts

Tax Lien Foreclosures

Delinquent Tax Payment

Surplus Funds