All Categories

Featured

Table of Contents

- – How long does a typical High-return Real Estat...

- – What does Accredited Investor Real Estate Deal...

- – Who provides reliable Real Estate Development...

- – How do I choose the right Real Estate Investi...

- – Who offers flexible Accredited Investor Real...

- – What is the best way to compare Commercial R...

Rehabbing a house is thought about an energetic financial investment technique - Accredited Investor Real Estate Investment Groups. You will supervise of working with improvements, managing specialists, and eventually making certain the residential or commercial property markets. Energetic approaches call for more effort and time, though they are connected with huge profit margins. On the various other hand, easy realty investing is wonderful for financiers who wish to take a less involved technique.

With these techniques, you can take pleasure in passive income over time while enabling your financial investments to be managed by another person (such as a building administration firm). The only thing to remember is that you can lose out on a few of your returns by employing another person to manage the investment.

An additional factor to consider to make when picking a genuine estate investing method is direct vs. indirect. Straight investments entail in fact purchasing or managing residential properties, while indirect approaches are less hands on. Many investors can obtain so caught up in determining a home type that they don't understand where to start when it comes to locating an actual property.

How long does a typical High-return Real Estate Deals For Accredited Investors investment last?

There are bunches of residential properties on the market that fly under the radar since financiers and property buyers do not know where to look. Some of these buildings struggle with bad or non-existent advertising, while others are overpriced when provided and as a result failed to receive any type of attention. This implies that those investors ready to arrange with the MLS can locate a range of financial investment opportunities.

In this manner, investors can regularly track or look out to brand-new listings in their target location. For those wondering just how to make connections with genuine estate representatives in their respective areas, it is an excellent idea to go to local networking or property event. Financiers browsing for FSBOs will certainly additionally discover it useful to deal with a realty agent.

What does Accredited Investor Real Estate Deals entail?

Capitalists can likewise drive with their target locations, looking for indications to find these residential properties. Bear in mind, determining properties can take some time, and investors ought to be ready to employ multiple angles to protect their following deal. For investors living in oversaturated markets, off-market buildings can represent an opportunity to get ahead of the competitors.

When it comes to looking for off-market homes, there are a few resources financiers should check. These consist of public documents, property public auctions, wholesalers, networking events, and specialists. Each of these resources represents an one-of-a-kind possibility to locate properties in a provided area. Wholesalers are commonly conscious of fresh rehabbed buildings available at practical rates.

Who provides reliable Real Estate Development Opportunities For Accredited Investors options?

Years of backlogged foreclosures and boosted inspiration for banks to repossess can leave also more repossessions up for grabs in the coming months. Financiers browsing for repossessions ought to pay cautious interest to newspaper listings and public documents to find potential homes.

You must consider purchasing realty after learning the different benefits this property has to use. Historically, real estate has actually done well as a possession course. It has a favorable relationship with gross domestic item (GDP), suggesting as the economic climate expands so does the demand for real estate. Generally, the regular demand uses property reduced volatility when compared to various other financial investment kinds.

How do I choose the right Real Estate Investing For Accredited Investors for me?

The factor for this is since actual estate has reduced correlation to other financial investment types therefore supplying some protections to investors with other possession kinds. Various sorts of property investing are related to different degrees of threat, so be certain to discover the best investment strategy for your goals.

The procedure of purchasing property entails making a down settlement and financing the rest of the sale rate. Therefore, you only spend for a tiny percent of the building up front however you manage the whole financial investment. This form of take advantage of is not offered with other investment types, and can be utilized to more expand your investment profile.

Due to the vast range of choices available, numerous capitalists most likely discover themselves wondering what truly is the best genuine estate financial investment. While this is a simple concern, it does not have a basic response. The ideal kind of financial investment residential property will depend upon many variables, and investors ought to take care not to dismiss any choices when looking for possible deals.

This short article checks out the possibilities for non-accredited financiers aiming to venture into the financially rewarding world of realty (Accredited Investor Real Estate Partnerships). We will certainly explore numerous financial investment opportunities, governing considerations, and techniques that empower non-accredited individuals to harness the potential of genuine estate in their financial investment portfolios. We will also highlight exactly how non-accredited capitalists can work to end up being certified financiers

Who offers flexible Accredited Investor Real Estate Platforms options?

These are generally high-net-worth individuals or business that meet certification requirements to trade private, riskier investments. Earnings Requirements: Individuals must have a yearly income exceeding $200,000 for two successive years, or $300,000 when combined with a spouse. Net Worth Need: A total assets going beyond $1 million, excluding the main home's worth.

Investment Knowledge: A clear understanding and awareness of the risks connected with the investments they are accessing. Documentation: Capability to provide financial declarations or various other documents to validate income and total assets when requested. Realty Syndications require certified financiers due to the fact that enrollers can only enable certified financiers to register for their financial investment possibilities.

What is the best way to compare Commercial Real Estate For Accredited Investors options?

The initial common mistaken belief is when you're an accredited investor, you can keep that standing forever. To become an accredited capitalist, one should either hit the earnings requirements or have the internet worth demand.

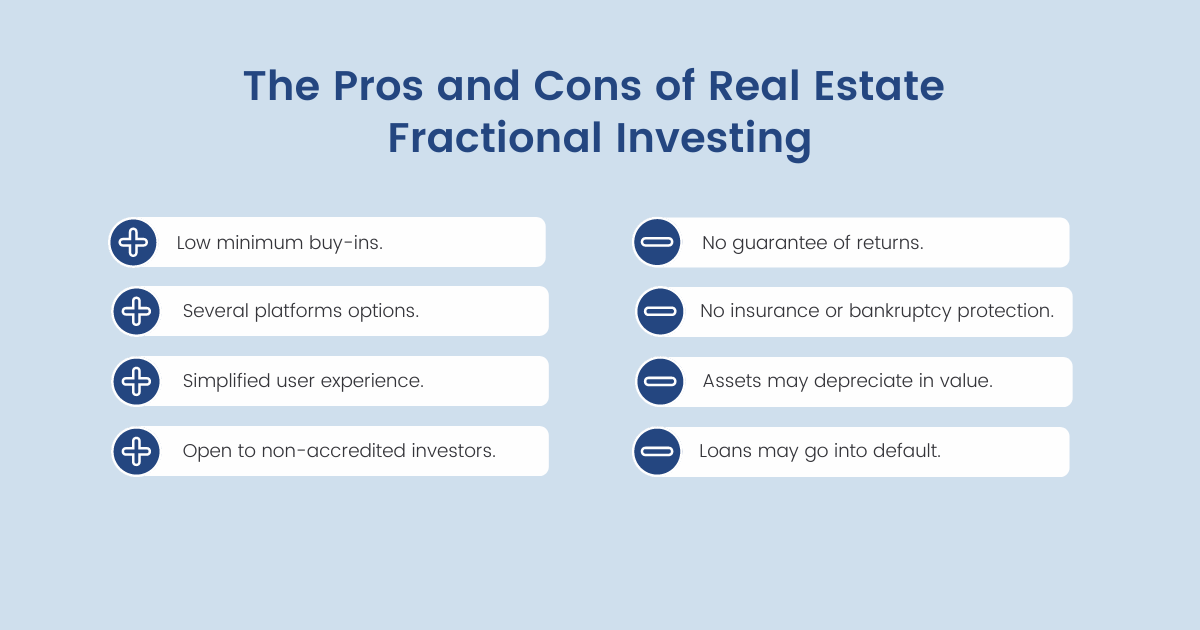

REITs are eye-catching due to the fact that they produce stronger payouts than typical stocks on the S&P 500. High return dividends Profile diversity High liquidity Dividends are tired as regular revenue Level of sensitivity to interest rates Dangers connected with particular residential or commercial properties Crowdfunding is an approach of online fundraising that includes requesting the public to contribute money or start-up funding for brand-new tasks.

This enables entrepreneurs to pitch their concepts directly to day-to-day net users. Crowdfunding offers the ability for non-accredited financiers to end up being investors in a company or in a property residential property they would not have had the ability to have access to without certification. An additional benefit of crowdfunding is profile diversity.

In numerous instances, the investment candidate requires to have a track document and is in the infancy stage of their job. This might mean a higher risk of shedding an investment.

Table of Contents

- – How long does a typical High-return Real Estat...

- – What does Accredited Investor Real Estate Deal...

- – Who provides reliable Real Estate Development...

- – How do I choose the right Real Estate Investi...

- – Who offers flexible Accredited Investor Real...

- – What is the best way to compare Commercial R...

Latest Posts

Tax Lien Foreclosures

Delinquent Tax Payment

Surplus Funds

More

Latest Posts

Tax Lien Foreclosures

Delinquent Tax Payment

Surplus Funds